RBI Introduces New ATM Charges: Withdrawals & Balance Checks to Cost Extra

In a significant change for Indian banking customers, the Reserve Bank of India (RBI) has announced new rules that will impose extra charges on ATM withdrawals and balance checks. This update is expected to impact millions of people who rely on ATMs for daily banking services. Here’s everything you need to know about the new charges and how they might affect you.

What Are the New Charges for ATM Transactions?

Starting soon, ATM withdrawals and balance checks will incur additional costs, especially when using machines that are outside your bank’s network. These charges are part of the RBI’s ongoing efforts to regulate the ATM sector and promote the use of alternative banking services.

Key Points of the RBI’s New Rule on ATM Charges

- Increased Charges on Out-of-Network ATM Transactions The extra charges will primarily apply when you use an ATM that is not part of your home bank’s network. Whether you’re withdrawing cash or checking your balance, you may find yourself paying ₹20 to ₹25 per transaction at non-network ATMs.

- Impact on Frequent ATM Users For people who frequently use ATMs for withdrawals or balance checks, these additional charges could add up quickly. If you’re accustomed to using ATMs outside of your bank’s network, this could significantly affect your monthly expenses.

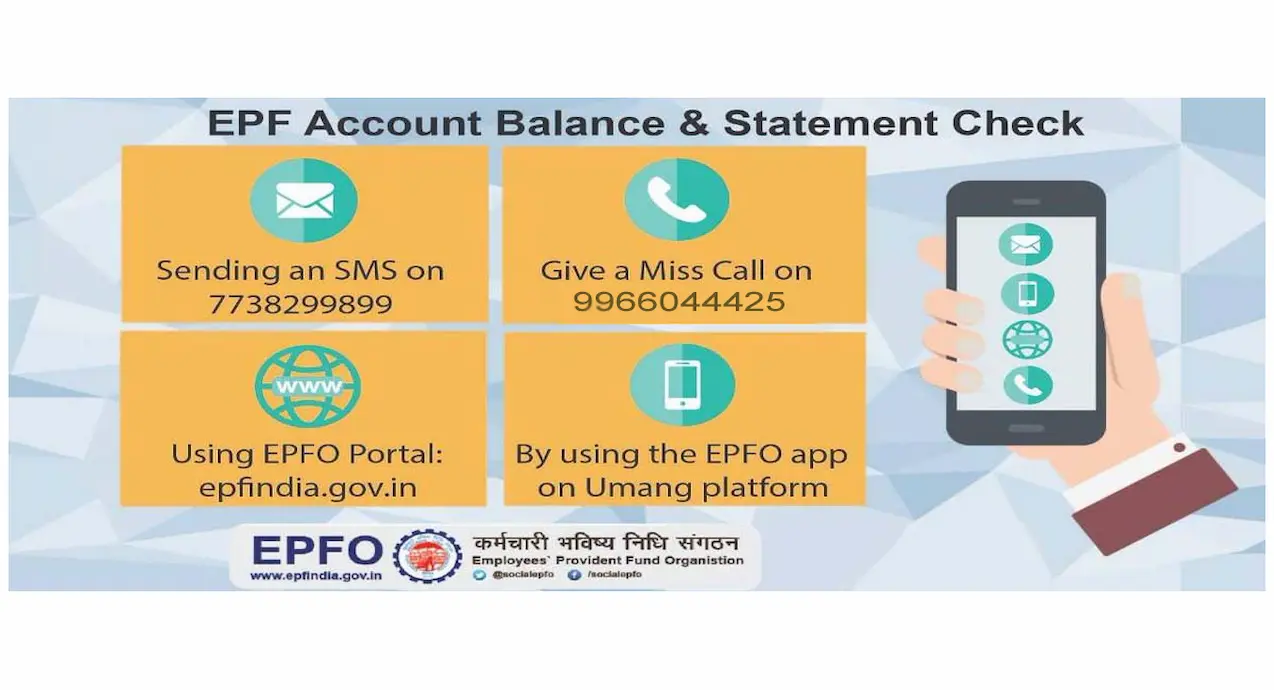

- Banking Alternatives to Avoid Extra Fees To minimize costs, customers can use their own bank’s ATMs for free transactions. Additionally, shifting to digital banking methods such as mobile banking apps, net banking, or UPI transactions could help users avoid these charges altogether, as these services often do not involve additional fees.

- Why the RBI is Introducing Extra Charges The RBI’s new directive aims to reduce the burden on banks by encouraging the use of digital banking solutions. This push towards digital transactions aligns with the government’s broader goal of promoting cashless and contactless banking in India. By imposing additional charges on ATM transactions, the RBI is encouraging customers to shift toward cost-effective online alternatives.

- How to Avoid Extra ATM Charges

- Use Your Bank’s ATM Network: Always opt for ATMs owned by your bank to avoid paying any extra charges.

- Switch to Digital Banking: Using mobile apps, online banking, or UPI platforms can help you manage your finances more efficiently without the added cost of ATM fees.

- Stay Informed: Be aware of your bank’s fee structure for ATMs and always check for updates from the RBI regarding any changes in charges.

The Bottom Line: How This Affects You

The new RBI ATM charges will affect customers who frequently use ATMs for basic banking services like withdrawals and balance checks, particularly when using out-of-network ATMs. While this may seem like an inconvenience, the change is designed to promote the shift toward digital banking in India.

By using your bank’s ATM and exploring digital banking solutions, you can easily avoid these new charges. Stay updated on the latest RBI guidelines to make the best financial decisions in response to these changes.

FAQs:

Can I avoid these charges? Yes, by using ATMs within your bank’s network or opting for digital banking channels, you can avoid extra fees.

Will these new charges apply to all ATMs? No, extra charges apply only to transactions made at ATMs outside of your bank’s network.

How much will I be charged for an out-of-network ATM withdrawal? The charge can range between ₹20 to ₹25 per transaction.

Catch today’s top stories and trending updates across News, Entertainment, Business, and Sports. Dive into expert Finance insights, market trends, and smart investment tips in our Finance hub.

Leave a Reply