Withdraw Large Amounts from Indian Bank Safely: Everything You Need to Know

Withdrawing a large sum from your Indian savings account may sound simple, but it involves more than just a visit to the bank. Whether you’re planning a major purchase, funding a business, or managing an emergency, understanding the rules and best practices can help you avoid delays, unnecessary scrutiny, or transaction failures. Here’s a complete guide to withdrawing large amounts from your Indian bank account securely and without hassle.

🏦 Understand Your Bank’s Withdrawal Policy

Each bank in India has its own daily and weekly withdrawal limits, especially when dealing with cash. While most savings accounts allow ATM withdrawals up to ₹25,000–₹50,000 per day, over-the-counter (OTC) withdrawals for larger amounts may require prior notice.

Tip: For cash withdrawals exceeding ₹2 lakh, some banks may ask for a written request and ID verification at least 1–2 days in advance.

📄 Keep Documentation Ready

If you’re withdrawing ₹10 lakh or more, be prepared with documents such as:

- PAN card (mandatory for withdrawals above ₹50,000)

- A valid reason for the transaction (especially in case of business or property dealings)

- Income proof, if required for large transactions

Banks may also report high-value transactions to the Income Tax Department as per the RBI guidelines and income tax laws.

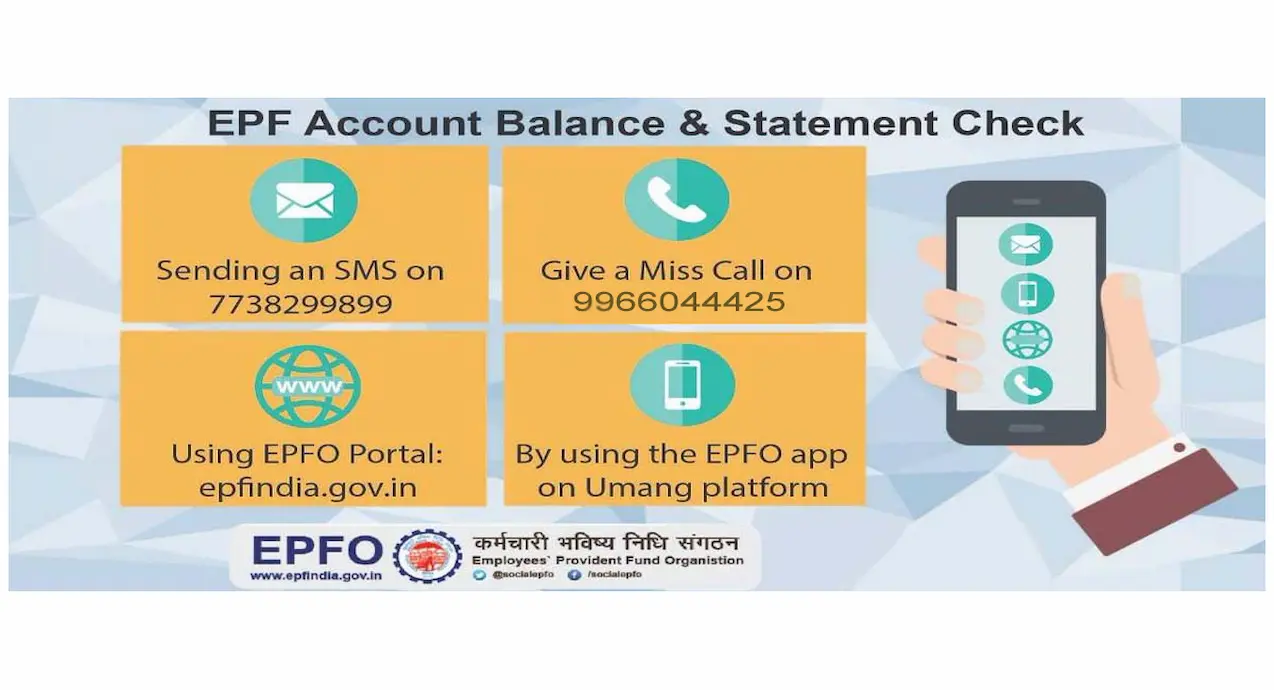

💳 Consider Digital and Cheque-Based Transfers

Instead of carrying large sums in cash, opt for safer options:

- NEFT/RTGS/IMPS for inter-bank fund transfers

- Account payee cheques for large payments

- Bank drafts for secure one-time payments

Digital routes leave a clear audit trail, reduce risk, and are often faster.

🛡️ Ensure Your Safety

If you must withdraw in cash:

- Avoid peak hours or crowded branches

- Bring someone trustworthy if you’re handling large sums

- Use bank-arranged cash delivery or escort services, if available

- Deposit cash in secure lockers or move it promptly to its intended purpose

⚖️ Stay Compliant with Income Tax Laws

Under current rules:

- Cash withdrawals exceeding ₹1 crore in a financial year from a bank attract TDS at 2% (Section 194N)

- The limit may be lower (₹20 lakh) if you haven’t filed ITRs for the last 3 years

It’s important to check your withdrawal history and tax status before initiating a large transaction.

✅ Final Thoughts

Withdrawing a large amount from your savings account in India is perfectly legal, but it requires planning, proper documentation, and a clear understanding of regulations. Following the right steps ensures a smooth process, avoids red flags, and keeps your funds—and your peace of mind—safe.

Catch today’s top stories and trending updates across News, Entertainment, Business, and Sports. Dive into expert Finance insights, market trends, and smart investment tips in our Finance hub.

Leave a Reply